- JohnWallStreet

- Posts

- The Sporting News Raises $15 Million to Build Out LTV Focused Digital Media Co.

The Sporting News Raises $15 Million to Build Out LTV Focused Digital Media Co.

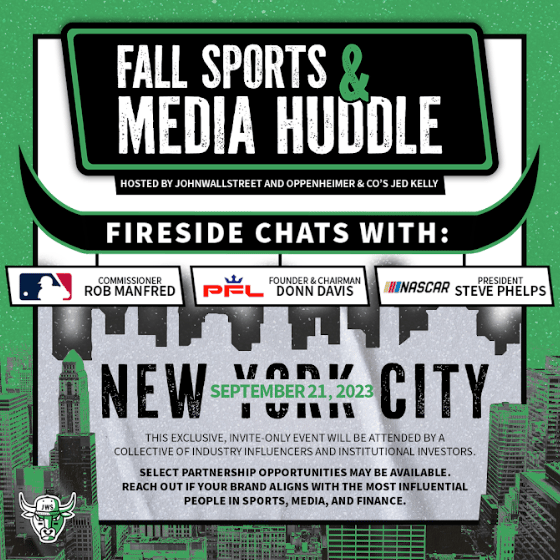

Editor’s Note: The Fall Sports & Media Huddle is one week from today and just a few seats remain. If you are holding a golden ticket, planning to attend, and have not already RSVP’d, please do so to ensure your spot.

The Sporting News Raises $15 Million to Build Out LTV Focused Digital Media Co.

TSN Holdings, the owner of The Sporting News (TSN), recently announced it raised $15 million. Playtech PLC, a publicly traded online sports betting operator and B2B tech provider (LON: TPEC), led the investment round.

TSN Holdings’ ability to successfully fundraise at a time when investor interest in digital sports media entities is lukewarm (at best) is noteworthy, and reflective of a differentiated approach to monetization.

Many digital media companies are focused on CPMs (think: the amount of money that can be generated per 1,000 page views, impressions etc.).

“For us, the core KPI is lifetime user value,” Rich Routman (global CEO, The Sporting News) said.

While the publisher plans to continue selling advertising, it has pivoted to become more ‘transactionally-led’. The business is now leveraging content, data, and organic traffic to drive commerce across a handful of key verticals.

“In travel, there are big businesses like Kayak. In finance, you have the Rocket Mortgages of the world. These businesses have been able to build audience and [subsequently] sell product or services to them on an affiliate basis,” Routman said. “But no one [in digital sports media] has fully captured this opportunity.”

More than 500 million people consume The Sporting News content each year.

The company figures “if [it] could get 1% to buy something, make a deposit into a sportsbook, subscribe to an OTT service, or purchase a collectible, [the affiliate revenue generated would] almost match the entire value of [the current] ad business,” Routman said. “Even at half a percent, it’s millions and millions of dollars.”

Most of the traffic TSN drives will go to third party sites. However, the opportunity does exist to convert readers into customers of O&O products and services too.

That would explain why the company opted to make a strategic investment into SuperDraft, an online DFS and fantasy player prop platform, back on July 1.

SPONSORED BY VISION INSIGHTS

Playfly Sports has released brand new MLB insights in its new report: Playfly Fan Score: MLB Edition powered by Vision Insights.

For example, Playfly has identified a new type of super fan called the Forever Fan. These fans have been fans since childhood and consider their favorite team to be a part of their identity. They are three times more likely to emotionally connect with their team’s sponsors, visit those advertisers’ apps or websites, and make a purchase from a brand aligned with their favorite team. Major League Baseball has the highest concentration of Forever Fans out of any of the four major sports leagues.

Playfly Fan Score also ranks teams based on 12 proprietary algorithms developed by the internal team of data scientists and the team at Vision Insights. All leading to a fresh perspective to understanding fandom including: Fan Passion, Fan Receptivity, Fan Marketplace.

Playfly Sports Consulting can help you with your team or brand needs.

Historically speaking, digital sports media businesses have sold advertising designed to drive consideration, intent, and upper funnel awareness for brand partners; or they have sold subscriptions. Over the last half decade, publishers needing to diversify revenue streams have added branded content or originals studios, social marketing businesses, and/or tech arms.

But none of those new business lines look at the fan in terms of revenue generated over a lifetime.

“We reach this number of users per month. That’s how the general industry speaks about the business,” Routman said. “I think of those [500 million people coming to The Sporting News annually] as a pool of potential customers that I need to surface, just like Facebook and Instagram do.”

Instagram and Facebook sell a ton of product. Sports publishers do not. Or, at least, they have not done so historically.

Performance marketing is now ~35% of The Sporting News business and the company anticipates that percentage climbing as it expands its strategic partner network.

If TSN can build a business that is ~50% traditional advertising and ~50% high-margin affiliate revenue it will “look a lot better on a P&L than most businesses in digital media, and become a great thesis to go out, raise money, and be able to bring other assets into the fold,” Routman said (think: digital media companies in other content verticals and geographies).

Remember, public companies often trade on multiples of EBITDA.

The long-time digital media executive believes TSN has the content strategy and data insights needed to execute specific outcomes across a trio of emerging categories.

Sports betting sits atop the list.

“There are a ton of markets around the world that are becoming regulated. [It’s] not just the U.S.,” Routman said (think: Brazil, Japan). “And at the end of the day, we’re contextualizing sports content in 13 different languages, across 20+ geos around the world. We can do that for a third party [operator], or we can do it for ourselves [as it plans to do with SuperDraft].”

Presumably, Playtech is hoping TSN can do the same for its O&O platforms.

Sports streaming isn’t far behind.

“With the proliferation of rights, no one knows where to watch anything anymore,” Routman said. “And each of those [emerging] services [that carries games], whether it’s Fubo, Roku, Amazon, or Apple, needs to develop awareness around the rights they have.”

Digital collectibles is another category Routman believes will bear fruit, eventually.

“Even though [the category] has experienced a decline over the last couple of years, it is positioned to have a nice recovery,” he said.

As the father of a six-year-old who just asked for Robux for the first time, that seems possible.

The Sporting News plans to generate revenues within more traditional verticals, like ticketing and merchandising, in the future too.

“Now you have enough categories, enough opportunities, especially if you’re global, to make transactional revenues your focus,” Routman said.

Building a performance marketing business inside of a big publishing group wouldn’t have made sense a decade ago.

Publishers in sports had “multi-million dollar brand opportunities across CPG, insurance, and several other key sponsorship categories,” Routman said. They simply “didn’t need to [take the risks involved in] building an affiliate business model because the density for advertising in sports [was] stronger than basically every other category.”

But times have changed. Top-down pressure now exists on the digital sports media advertising business and public market investors want to see these companies reach profitability. Affiliate businesses have the potential to generate 70-80% profit margins.

Getting 1% of the audience to buy something may sound easy. It’s not.

“You have to fully understand the user and their respective journey; where they came to you from, what they came to you for, their time on site, their scroll depth, their behavior once they are on the site, and their historical behavior with your product, amongst many other data points, Routman said. And “more often than not, converting a user at first exposure is unlikely to happen. So, how you leverage this data going forward [becomes] the key to enabling a conversion further down the line,” Routman said.

But he was confident The Sporting News would be able to convert users when he signed on last September because he knew the technology behind the platform worked. See, this isn’t Routman’s first go-around with TSN. He served as president and CRO of Sporting News Media when it was under Perform Group control in the early to mid-2010s.

Perform, now DAZN, sold TSN to a private investment group (Pax Holdings) led by Asian gaming veteran Tom Hall and DAZN co-founder John Gleasure in January ’21. The investment group saw an “iconic sports media brand, with super rich domain authority, that had really become great over the years generating subscribers for DAZN,” Routman said, and figured it could leverage the components into a larger, more diversified transactional business.

If successful, other publishers are certain to try and follow TSN’s lead.

“There has to be access to capital if you want to further a business like this,” Routman said. “And at the end of the day, access to capital for digital media businesses is hard to come by right now.”

But he cautions that commerce is a harder revenue stream to tap into than some of the others publishers are trying to unlock.

“You’re becoming more of a data business than just a content business,” he said.

That doesn’t mean publishers should shy away.

Those “that are able to correlate what they’ve been able to build [with] an LTV-focused business model are going to be the next group of successful businesses in digital media–because that’s what the market is interested in seeing,” Routman said.

Top 5 Sports Business Headlines

Click here to subscribe to Sport & Story Daily and never miss a story.

🏁 NBC Sports delivers most-watched NTT Indycar series season in 12 years

🌎 NHL and NHLPA now planning to hold a scaled-down World Cup of Hockey in 2025

🎾 Major League Pickleball and PPA Tour unite with $50M backing

🤼 WWE delivers TKO to Tampa

🤝🏼 LEARFIELD revealed the closing of a recapitalization transaction and equity investment in ownership shift