- JohnWallStreet

- Posts

- NFL Outlaws Employee Equity, But Comp. Structure Makes Sense for Select Challenger Leagues

NFL Outlaws Employee Equity, But Comp. Structure Makes Sense for Select Challenger Leagues

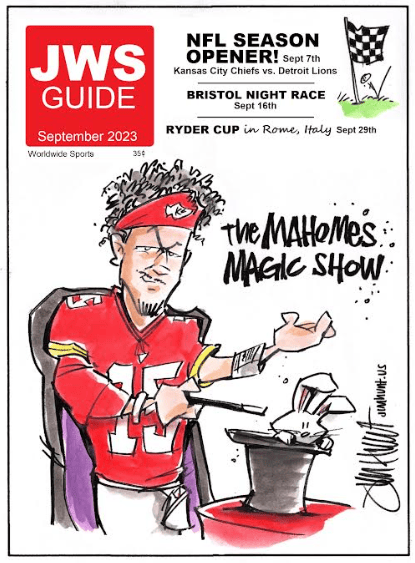

Editor’s Note: The talented sports cartoonist Jim Hunt is back with a new template and a drawing that highlights a few of September’s most anticipated events (one of which happens to be tonight). While you’re waiting for the game to start, you can check out some more of his work here.

NFL Outlaws Employee Equity, But Comp. Structure Makes Sense for Select Challenger Leagues

The National Football League recently adopted a rule that will prevent players and other non-family employees from holding an equity interest in its teams. The league cited six potential pitfalls associated with such arrangements, including those that could arise if the individual were to leave unceremoniously.

Taking a stance against employee equity seemingly makes sense for the NFL, as it would for any other top league —or brand— in the world. There’s more potential downside than upside (think: increase in valuations) for an established property.

But that’s not necessarily the case for a league competing in a sport like soccer, where the talent is more widespread. And certainly not for challenger properties in competitive markets.

SPONSORED BY VISION INSIGHTS

Playfly Sports has released brand new MLB insights in its new report: Playfly Fan Score: MLB Edition powered by Vision Insights.

For example, did you know the Mets deliver a larger audience in New York than the Knicks and Rangers combined? As the MLB pennant races start heating up, Playfly has uncovered many more insights about MLB Fandom.

According to Forbes: “The Playfly Sports report, working with Vision Insights, is a valuable view into the under told story of Major League Baseball as valuable advertising sports property.”

Playfly Fan Score ranks teams based on 12 proprietary algorithms developed by the internal team of data scientists and the team at Vision Insights. All leading to a fresh perspective to understanding fandom including: Fan Passion, Fan Receptivity, Fan Marketplace.

Playfly Sports Consulting can help you with your team or brand needs.

Lionel Messi received equity in Inter Miami CF as part of the robust compensation package that drew him to MLS. He can reportedly exercise his stake in the franchise once his playing career with the club ends.

But the NFL’s recent ownership vote was not a reaction to the soccer star’s deal. In fact, the policy was crafted by the league’s finance committee prior to the Argentinian star signing with Miami.

The NFL has wanted to address the employee ownership issue since it was forced to suspend Miami Dolphins owner Stephen Ross for tampering with then Patriots star Tom Brady in late ‘21/early ‘22. Those conversations reportedly centered on the QB becoming an LP in the franchise.

The topic rose to the surface again when word got out that several club executives were seeking equity as part of their comp. packages. And then in May of this year, the Los Angeles Raiders announced Brady agreed in principle to take an ongoing role in the organization and an ownership position in the franchise.

So, the owners decided to get out in front of a burgeoning issue.

“For the NFL, this was absolutely the right thing to do,” Marc Ganis (president, Sportscorp Ltd.) said. “Because fairness to every team is in the league’s DNA.”

If one team were willing to offer an employee equity and another was not, the former may enjoy a competitive advantage in negotiations.

The NFL also wants to prevent against an arms race–even if it seems unlikely that many owners, particularly those who made fortunes outside of the sport, would ever agree to give up equity to an employee. Those individuals understand there is no viable alternative or competing league to go to (at least on the player front), believe club valuations will continue to appreciate, and do not want additional locker room conflicts emerging.

The league would also like to avoid a dynamic that could negatively alter valuations.

When everyone is investing their own capital, there are no motivations that would logically lead to a distressed sale. But in an employment situation, when someone leaves, an organization could find itself with a less caring LP and/or one in need of liquidity.

Toss in additional concerns about who would have access to confidential information and one can understand how the vote turned out to be almost unanimous.

It’s fair to wonder why any billionaire owner would be in favor of giving up equity to an employee. One presumes they would all prefer, and have the resources needed, to attract them without having to offer it.

But different owners have different mindsets. And to some, it might make sense to give away an LP interest to land the employee of his or her dreams.

Remember, there are club owners who inherited franchises worth a fraction of their value today. If they could give up a small piece of equity to gain a competitive advantage, some might consider doing it.

Control owners with many LPs also tend to be apt to doing equity deals.

“When you have a single family or single owner, they’re not giving up equity,” Ganis said. “But when you have 5, 10, 15, 20, 30, 50 limited partners, and the control owner only owns 15 or 20% [of the franchise], then [he or she is] giving up very little.”

Diluted ownership structures are more prevalent across the NBA and MLB than they are in the NFL.

But the NBA does not allow active players to hold direct or indirect ownership stakes in its teams, either.

Players can, however, take ownership in WNBA franchises. The CBA also allows for the NBPA to invest passively in teams, on behalf of all players, via a league approved PE fund.

Major League Baseball rules prohibit employees (and their spouses) from owning interests in other organizations. But they do not prevent players, managers, or other employees from owning a stake in the club they work for provided they receive the Commissioner’s consent and there is a mechanism in place to immediately dispose of the interest should they join another team.

Of course, just because it isn’t prohibited by the CBA does not mean it would be allowed. There is said to be a an extraordinarily high bar to clear for Commissioner approval.

While the potential downside may outweigh the upside for a mature sports property, that is not the case for challenger properties with larger ambitions, like Major League Soccer or the Saudi Pro League.

“In the context of having competitive leagues in different geographic regions of the world, some with effectively unlimited resources, equity might be a way to go to attract some of these players,” Ganis said.

But megastars capable of move the needle like Messi are “the rare exception, not the rule,” Ganis cautioned.

And once a club awards equity to one employee, agents will begin arguing their top clients deserve comparable treatment.

Preventing wealthy employees from buying into clubs may seem like it runs counter to the leagues’ desire to keep valuations rising. But athlete or executive salaries/bonuses remain a drop in the bucket relative to recent sale prices, and it’s not as if those individuals are going to be putting up a meaningful percentage of their assets anyway.

For valuations to keep tracking up and to the right leagues must a) have a good business model and b) work on the financial structure of acquisitions (i.e., more debt or more LPs), so that they are maximizing the number of qualified potential bidders.

Top 5 Sports Business Headlines

Click here to subscribe to Sport & Story Daily and never miss a story.

🏁 CW revs up for NASCAR Xfinity Series

🎤 Alex Rodriguez inks exclusive Fox Sports deal

🏏 Coca-Cola punches ticket to ICC Cricket World Cup

📢 Sports Broadcasting Hall of Fame inductees revealed

😫 Fox, Flutter to shutter sports-betting biz Fox Bet